Making the Most of Conferences: Leveraging AI for Startup Matchmaking

The Role of Data Integration in Modern Data Sourcing

Unlock the full potential of your venture capital firm with data-driven software solutions. At Sunscrapers, we leverage advanced software, AI, and real-time data insights to provide you with tools you need to stay ahead in a competitive market.

Unlock meaningful, real-time insights about founders and startups through data signals.

Back your instincts with data, streamline due diligence, and forecast future performance.

Boost operations and productivity through AI-powered automation.

Stay ahead and future-proof your firm with modern tech stack and cloud solutions.

From identifying promising opportunities to accelerating portfolio growth, we can help you streamline your entire deal flow.

01: FIND

Leverage powerful deal sourcing platforms and data enrichment tools to spot high-potential investments ahead of the competition.

02: DECIDE

Automate screening and due diligence processes. Use real-time financial reporting, benchmarking, and forecasting to make confident, data-backed investment decisions.

03: WIN

Enhance team communication and streamline workflows with integrated knowledge repositories, CRM enrichment, and custom Slack bots.

04: HELP

Support your portfolio companies with online community platforms, vendor management solutions, and programmatic recruitment tools.

05: EXIT

Leverage network management and online LP platforms to enhance communication with your investors and deliver transparency.

From consulting and data engineering to advanced analytics and web development, we provide the expertise and solutions you need to transform your operations.

Create a solid foundation for your data-driven transformation through discovery workshops, software nad infrastructure audits, and architectural planning.

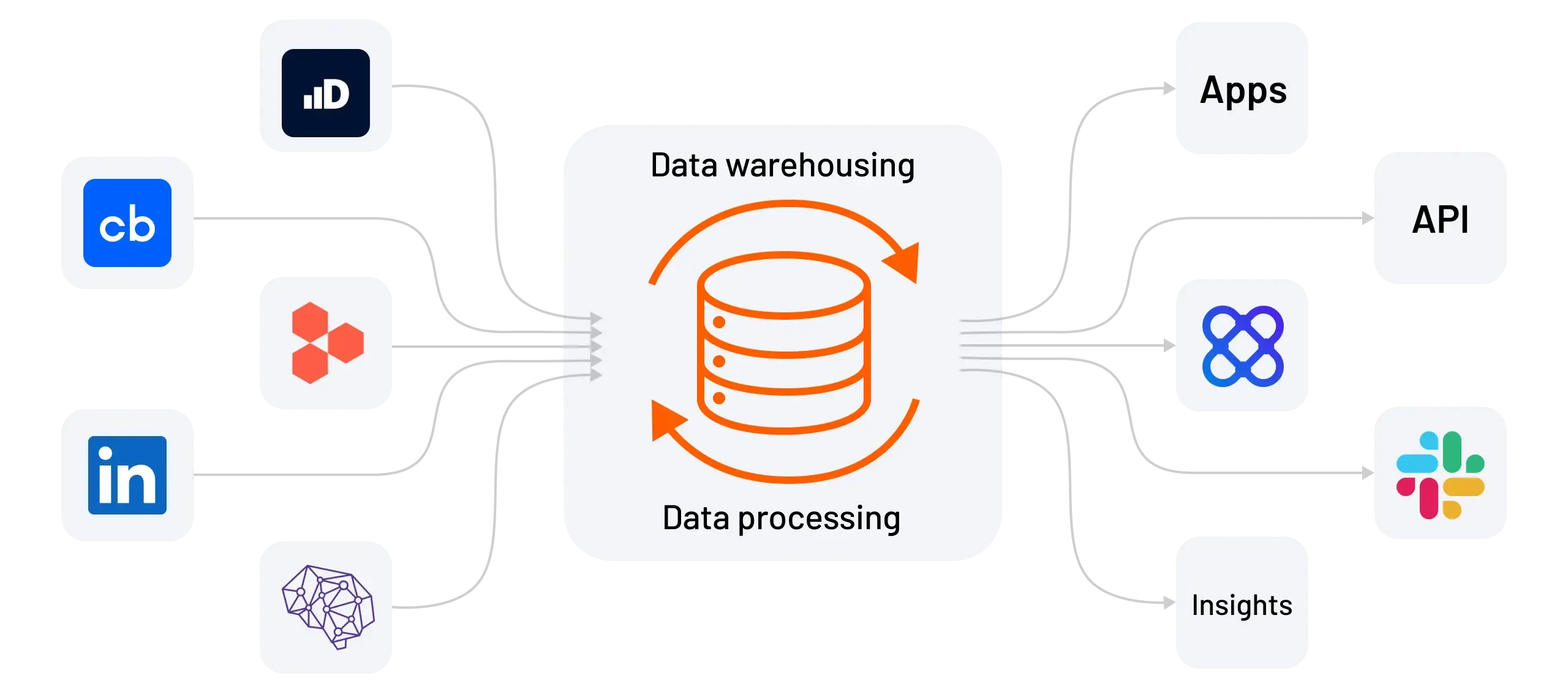

Learn moreWe can integrate data from internal and external sources and enrich it for maximum value. We can also help with data transformation and storage through data pipelines and warehousing services.

Learn moreLeverage AI and ML to extract meaningful insights from data. We can help you discover trends, forecast outcomes, and make smarter decisions with data analytics, BI, and R&D services.

Learn moreMake your data actionable with interactive dashboards, automated workflows, and custom web applications.

Learn moreDeal sourcing

SourceScrub

SourceScrub tracxn

tracxn Cyndx

Cyndx Synaptic

Synaptic Maiden Century

Maiden Century Kaiku

Kaiku Crunchbase

Crunchbase Dealroom

DealroomFounded

Clients

Projects

Client’s rating

Discover how software, data, and AI can accelerate your growth. Let's discuss your goals and find the best solutions to help you achieve them.